Are Progressive Jackpots Paid Out In Lump Sums Or Annuities?

Have you ever wondered whether progressive jackpots are paid out in lump sums or annuities? Well, you’re in the right place! In this article, we’ll delve into the fascinating world of progressive jackpots and answer that burning question. So, grab your favorite snack and get ready to unravel the mystery behind these exciting payouts.

Nowadays, progressive jackpots are a popular feature in many casino games and lotteries. But what exactly are they? Picture this: a jackpot that grows with every bet placed until one lucky person hits the jackpot. It’s like watching a pot of gold slowly filling up, waiting for someone to claim it. But here’s the twist: how is the prize money paid out? Lump sum or annuity? Let’s dive deeper and find out!

When it comes to progressive jackpots, things can get pretty interesting. The payout method can vary depending on factors like the game, the casino, or the lottery organizer. It’s like a Choose Your Own Adventure book, with different possibilities at each turn. So, are you ready to uncover the mysteries of progressive jackpot payouts? Let’s get started!

Are Progressive Jackpots Paid Out in Lump Sums or Annuities?

Progressive jackpots are a popular feature of many casino games, offering the chance to win life-changing sums of money. However, when it comes to claiming these jackpots, one question that often arises is whether they are paid out as lump sums or annuities. In this article, we will delve into the world of progressive jackpots and explore how they are typically paid out.

Understanding Progressive Jackpots

Before we dive into the payout options, let’s first understand what progressive jackpots are. A progressive jackpot is a constantly accumulating prize pool that increases every time the game is played. Every time a player makes a wager on the game, a portion of their bet goes into the jackpot pool, allowing it to grow rapidly over time. These jackpots can be found in a variety of games, such as slot machines, poker, and lottery-style games.

Progressive jackpots can reach astronomical sums, often reaching the millions or even tens of millions of dollars. This is what makes them so enticing to players around the world. However, once a lucky player hits the jackpot, the question of how the winnings are paid out becomes crucial.

Lump Sum Payouts

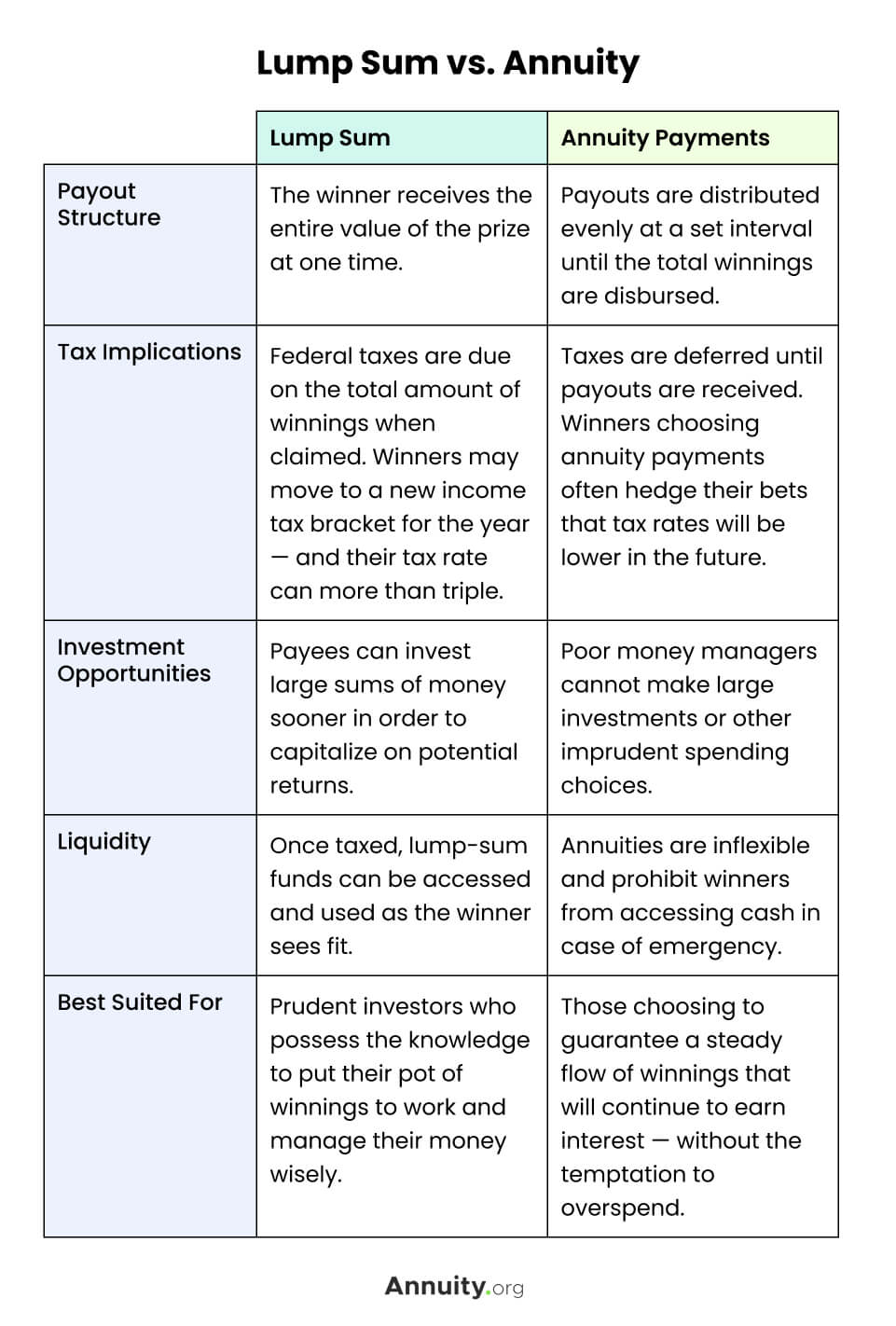

One option for receiving a progressive jackpot prize is through a lump sum payout. In this scenario, the winner receives the entire jackpot amount in one large payment. This can be a tempting option for those who want immediate access to their winnings and the freedom to spend it as they please. With a lump sum payout, the winner can choose to invest their money, purchase expensive items, or simply enjoy a life of luxury.

However, it’s important to consider the tax implications of a lump sum payout. Depending on the country and jurisdiction, a significant portion of the jackpot may be subject to taxes, which can significantly reduce the final amount received. Additionally, managing such a large sum of money requires careful planning and financial responsibility to ensure long-term financial stability.

Annuity Payouts

The other option for progressive jackpot winners is to receive their winnings through an annuity. An annuity is a structured payout system that distributes the jackpot over a specific period of time, typically in the form of regular payments. This option provides the winner with a steady stream of income over several years, ensuring financial security in the long term.

Annuity payouts are often designed to ensure that the winner receives a predetermined amount each year, regardless of market fluctuations or personal spending habits. This can be a wise choice for those who want to avoid the temptation of spending their entire winnings at once. Additionally, annuity payouts are usually not subject to the same level of taxation as lump sum payouts, making them a potentially more tax-efficient option.

The Pros and Cons

Now that we’ve explored the two payout options, let’s weigh the pros and cons of each:

Lump Sum Payouts:

Pros:

- Immediate access to the full jackpot amount

- Freedom to spend or invest the money as desired

- Potential for higher returns on investments

Cons:

- Higher tax implications

- Requires careful financial planning for long-term stability

- Potential for reckless spending or mismanagement of funds

Annuity Payouts:

Pros:

- Guaranteed income over a specific period of time

- Lower tax implications

- Protection against reckless spending

Cons:

- Lack of immediate access to the full jackpot amount

- Reduced flexibility in managing the funds

- Potential for missed investment opportunities

Choosing the Right Payout Option for You

When it comes to deciding between a lump sum or annuity payout for a progressive jackpot, there is no one-size-fits-all answer. It ultimately depends on your personal financial goals, spending habits, and desire for immediate or long-term financial security. Consulting with a financial advisor is always recommended to fully understand the tax implications and make an informed decision.

The Impact of Progressive Jackpot Payouts

Progressive jackpots have the power to change lives in an instant, providing winners with unprecedented wealth. However, it’s important to remember that responsible financial management is crucial, regardless of the chosen payout option. Whether it’s a lump sum or annuity, winners should seek professional advice to ensure their newfound wealth is handled wisely and used to build a secure and fulfilling future.

Key Takeaways: Are Progressive Jackpots Paid Out in Lump Sums or Annuities?

- Progressive jackpots can be paid out in either lump sums or annuities.

- A lump sum payout gives the winner the full jackpot amount immediately.

- Annuities spread the payout over a period of time, providing consistent income.

- Some jackpot winners choose annuities to ensure long-term financial stability.

- The decision between lump sum and annuity payout depends on personal preferences and financial goals.

Frequently Asked Questions

When it comes to progressive jackpots, there is a lot of curiosity surrounding how they are paid out. Here are some common questions and their answers:

1. How are progressive jackpots paid out?

Progressive jackpots can be paid out in different ways depending on the casino or game. In some cases, the jackpot may be paid out in a lump sum, which means you receive the full amount at once. This can be enticing for those looking for a big windfall. However, in other cases, the jackpot may be paid out in the form of annuities.

Annuities are regular payments made over time, usually monthly or yearly, until the full jackpot amount is paid. This option provides a more stable income stream for winners, ensuring they don’t blow through the entire amount immediately. The specific payout method can vary, so it’s important to read the terms and conditions of the game or casino you’re playing at.

2. What are the advantages of receiving a lump sum payment?

There are a few advantages to receiving a lump sum payment for a progressive jackpot. Firstly, it gives you immediate access to the full amount, allowing you to use it as you see fit. Whether you want to invest, pay off debts, or splurge on a dream vacation, a lump sum payment gives you that flexibility. It can provide a life-changing amount of money all at once.

Additionally, a lump sum payment avoids the risk of inflation devaluing the future annuity payments. Over time, the value of money can decrease due to inflation, so receiving a lump sum ensures you get the full value of the jackpot in today’s dollars. However, it’s important to carefully consider your financial goals and consult with professionals before making a decision.

3. What are the advantages of receiving annuity payments?

While a lump sum payment has its advantages, there are also benefits to receiving progressive jackpot winnings as annuity payments. One advantage is the financial security it provides. Annuity payments ensure a steady stream of income over time, which can be especially useful for those who want to budget and plan for the future.

Receiving annuities also reduces the risk of mismanaging a large sum of money. It’s not uncommon for lottery winners to blow through their winnings quickly and end up in financial trouble. Annuity payments help prevent this by limiting the amount of money received at once, ensuring a more disciplined approach to managing the winnings.

4. Can I choose how I want to receive the progressive jackpot?

The ability to choose whether to receive a progressive jackpot as a lump sum or annuity payment depends on the specific game or casino. Some may give you the option to choose, while others have predetermined payout methods. It’s important to review the rules and regulations of the game or casino to understand what options are available to you.

If you do have the choice, take the time to consider your financial goals, consult with professionals, and weigh the advantages and disadvantages of each payment method. This will help you make an informed decision that aligns with your long-term plans and financial well-being.

5. Are progressive jackpot winnings subject to taxes?

Yes, progressive jackpot winnings are generally subject to taxes. The specific tax regulations vary depending on the country and jurisdiction you are in. In many cases, the casino or game operator will automatically withhold a certain percentage of the winnings for tax purposes.

It’s important to consult with a tax professional to understand your tax obligations and any potential deductions or exemptions that may apply to your situation. This will ensure that you comply with tax laws and properly report your winnings, avoiding any legal issues in the future.

$1 Billion Jackpot: Would You Take an Annuity or Lump Sum? [Financial Breakdown]

Summary

So, to wrap it up in kid-friendly terms: progressive jackpots can be paid out in either a lump sum or as annuities. A lump sum means you get all the money at once, while an annuity pays you in instalments over time. Each option has its pros and cons that winners need to consider. It really depends on personal preferences and financial goals. Whether you choose a lump sum or annuity, winning a progressive jackpot is a dream come true!